Just because you outperform doesn’t mean you’re alpha

Imagine a marathon held on the same course every year. One year, the winner crosses the finish line in record time, helped by the weather conditions. In the next edition, the winner achieves a similar time, but in much more difficult conditions: heavy rain and strong headwinds. In both cases, the riders achieved impressive results, but only one of them demonstrated superior qualities. The same is true of what is known in finance as ‘alpha’ and ‘superperformance’, and we’ll see why.

In investing, when you outperform a benchmark index or another investment, you can say without thinking too much that you have outperformed. However, this does not explain how these returns were achieved or whether they justify the risks that were taken.

Alpha, on the other hand, goes further. It calculates the added value of a manager after taking into account market movements and risk. Alpha is, in a way, a measure of skill that makes it possible to distinguish between the part of the result attributable to the manager’s own talent and the part attributable to external conditions.

Understanding alpha

If, after investing in a fund or a share, the market rises by 9% in a year and your investment also makes +9%, you have followed the market, without adding any particular value. But if your portfolio is up 12% while the market is only up 9%, what can we say about this 3% difference? Can we talk about outperformance because you have gained more than the market?

It’s not quite that simple. Outperformance does not necessarily mean alpha. Alpha is only that part of the gain that comes from real added value, such as better stock selection or successful active management. Calculating alpha helps to distinguish good investors from those who have simply been lucky. It is a key indicator of whether an investor or fund manager is really adding value.

Two very different concepts

So why is this distinction so important? Outperformance without context can be misleading. A manager can beat his benchmark by taking excessive risks or by taking advantage of favourable market trends – neither of which necessarily reflects competence or a sustainable strategy. This is why alpha calculation is so important. It ensures that you are evaluating performance correctly.

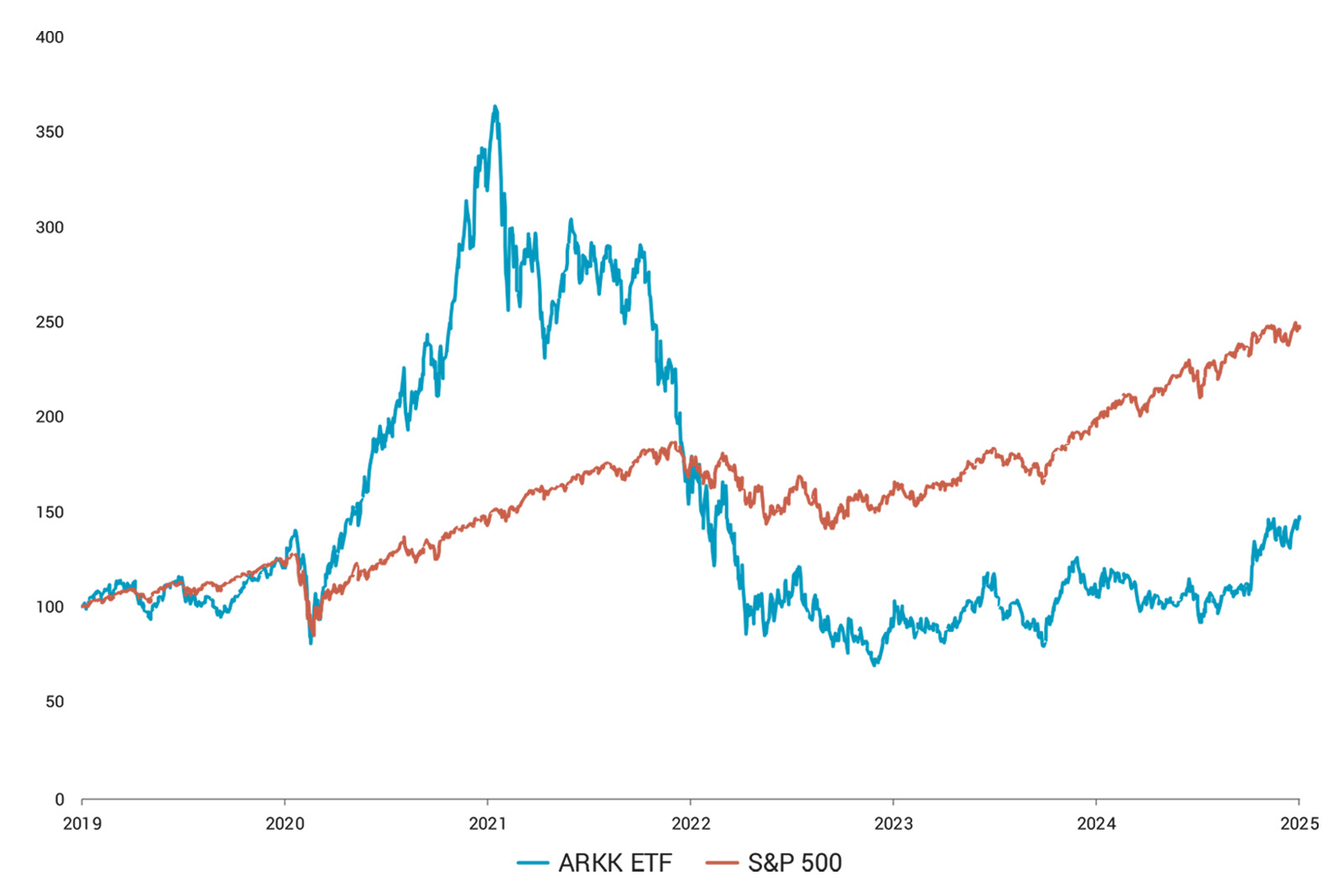

Not so long ago, there was a lot of talk about ARK Invest’s flagship fund, the ARK Innovation ETF (ARKK). At the height of its popularity in early 2021, ARKK attracted attention for its impressive returns, heavily concentrated in stocks like Tesla and other speculative names in the disruptive innovation sectors. Although these stocks rose in favourable market conditions, ARKK’s reliance on market conditions meant that much of its outperformance could be traced to increased exposure to market fluctuations rather than unique stock-picking skills. When the markets turned in 2022 and beyond, ARKK suffered dramatic losses, even falling more than 55% from its peak, highlighting how relying on strategies that focus on stocks that rise sharply when things are going well, and collapse when conditions change, can lead to significant declines.

Source: Bloomberg / Performance rebased to 100 on 31/01/2019

Risks and implications

Understanding alpha can help you make better investment decisions. Positive alpha indicates that a manager has added value beyond what the market could have passively offered, while negative alpha suggests underperformance after adjusting for risk. By focusing on alpha rather than just gross returns, you can identify strategies that not only perform well, but are also sustainable over the long term.

Ignoring this distinction poses a certain danger: if you follow funds or stocks with high-beta performance – i.e. products that react strongly to market movements – you could find yourself exposed to unnecessary risk in difficult times, eroding your long-term wealth. ARKK’s recent difficulties serve as a warning to assess performance from an alpha perspective rather than being dazzled by short-term gains fuelled by speculative bets.

So, the next time you want to adjust your portfolio allocation or hire an investment manager, remember this: while outperformance may seem attractive at first glance, alpha reveals the truth about competence and value creation. To outperform in investing, as in winning a marathon, it’s not enough to run fast; you have to run smart.

Joan Bürgy

Investment Specialist

You may also like

Market Update – May 2025

April 2025 was a dramatic month for global financial markets, with policy shocks and volatility echoing crisis times. President Trump’s new tariffs triggered a rapid and severe market sell-off, shaking the confidence and sending all major asset classes lower in a rare “triple sell-off” more commonly seen in emerging markets.

Small Fortunes and Big Banks: A Narrow Path Forward

As Swiss banking giants increasingly focus on ultra-wealthy clients, independent asset managers are emerging as a flexible and compelling alternative for those with more modest wealth.

Being a Woman and a Leader in Finance is a Strength

In a traditionally male-dominated industry, Petra Kordosova embodies a confident, committed, and resolutely modern form of female leadership. As CFO and Head of Compliance & Risk at Telomere Capital, she shares her vision of a financial world where performance, technology, and human values go hand in hand.