What impact do economic cycles have on financial markets?

Economic cycles, true oscillations of economic activity, lie at the heart of financial market dynamics. These cycles, often shaped by complex factors, influence the performance of financial assets and guide investment strategies. Being able to interpret these cycles not only deepens our understanding of the economy but also helps optimize the management of a financial portfolio. This article explores the foundations of economic cycles, their interaction with financial markets, and the strategies investors can adopt to take advantage of them.

Economic Cycles

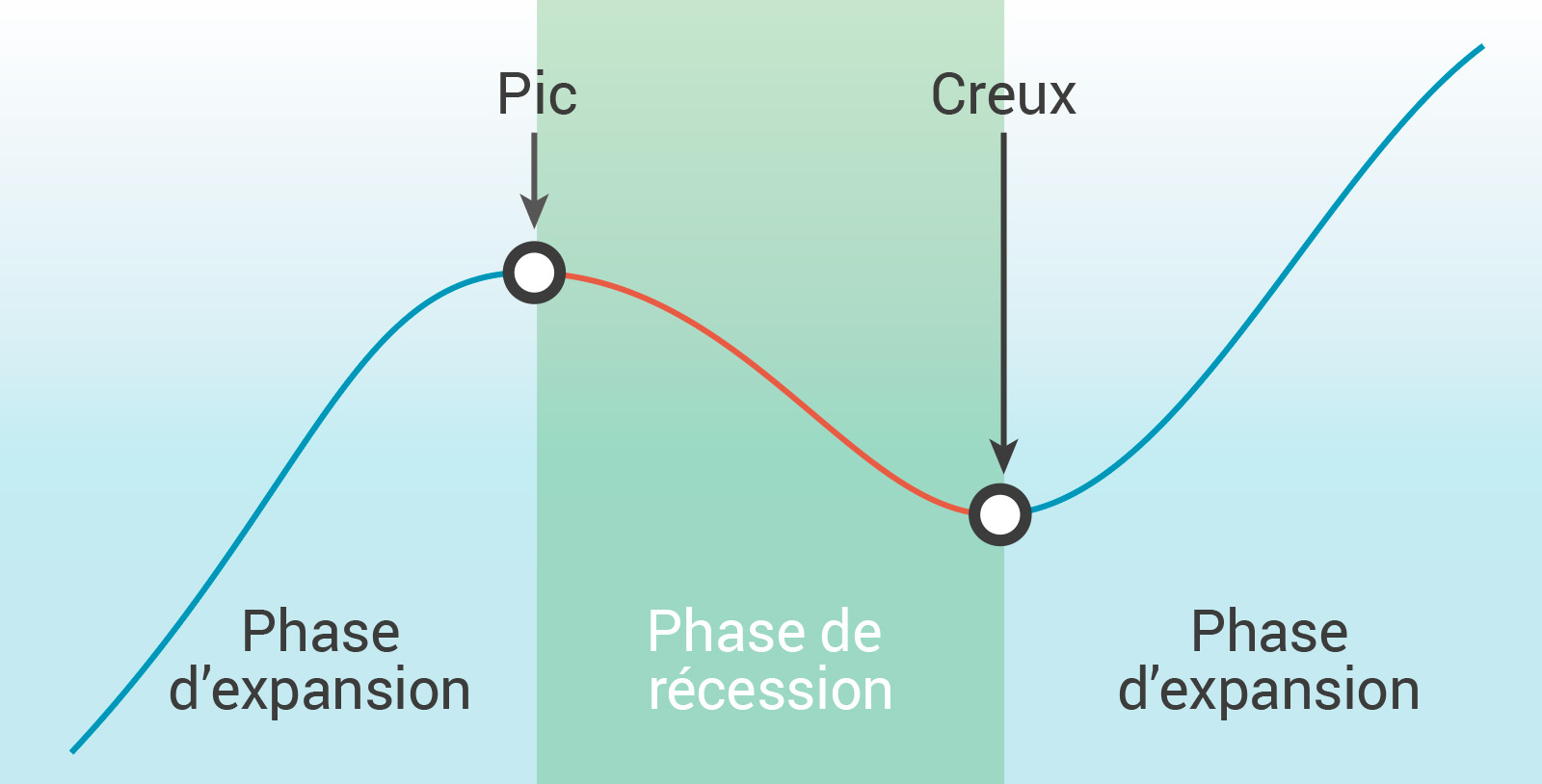

An economic cycle refers to the fluctuations in overall economic activity, measured through indicators such as gross domestic product (GDP), unemployment rate, consumption, and investment. Although these cycles do not follow a fixed rhythm, they share common characteristics. Typically, they are divided into four main phases:

-

- Expansion

Expansion is a phase of sustained economic growth. Businesses increase their production, consumers spend more, and unemployment falls. This period is marked by widespread optimism and rising investments. - Peak

The peak marks the cycle’s high point. At this stage, the economy operates at full capacity, but signs of overheating may emerge. Inflation often begins to rise, prompting central banks to adopt tighter monetary policies, such as raising interest rates. - Recession

Recession is characterized by a significant slowdown in economic activity. Output declines, unemployment rises, and investor confidence collapses. Companies cut costs, often through layoffs or budget reductions, and consumers scale back their spending. - Trough

The trough marks the lowest point in the economic cycle. While economic activity is weak, this phase usually sets the stage for recovery. Monetary or fiscal stimulus measures, along with stabilizing demand, can trigger a new expansion phase.

- Expansion

Influencing Factors

While the phases of an economic cycle follow a certain logic, various internal and external factors can influence their trajectory and duration:

-

- Monetary and fiscal policy: Central banks and governments play a key role in economic cycles. Interest rate changes, tax decisions, or adjustments to public spending can all impact the cycle. An accommodative monetary policy can prolong expansion, while tightening can hasten a recession.

- Technological innovation: Major technological breakthroughs, like the introduction of artificial intelligence or the rise of renewable energy, can spark new cycles of investment and growth.

- External shocks: Unforeseen events such as a pandemic, war, or financial crisis can disrupt the cycle’s phases and trigger significant volatility in financial markets.

Interaction Between Economic Cycles and Financial Markets

Economic cycles and financial markets are closely intertwined. Investors adjust their strategies based on different phases of the cycle, while markets themselves can influence the cycle, through interest rate movements, asset price changes, or shifts in investment behavior. Certain strategies and asset classes tend to perform better in specific phases:

1. Expansion Phase: A Golden Period for Equities

During expansion, companies typically post strong results, boosting stock markets. Cyclical sectors like consumer discretionary, real estate, and energy often perform particularly well. Following the 2008 financial crisis, for example, the stock market rebounded sharply: the S&P 500 quadrupled between 2009 and 2020. However, overvaluation during this phase can leave markets vulnerable to corrections.

2. Peak Phase: Volatility and Caution

When the economy hits its peak, signs of slowdown begin to appear. Equities become volatile. Investors often shift toward safer assets, such as bonds or cash. In 2007, just before the financial crisis, stock valuations were at historic highs, but rising interest rates and stress in the housing market quickly triggered a recession.

3. Recession Phase: Seeking Safety

Recessions typically lead to falling stock prices, especially in economically sensitive sectors like technology. Investors turn to safe-haven assets. Defensive sectors such as healthcare or consumer staples offer opportunities, as they are less affected by economic downturns. Government bonds also provide protection against uncertainty.

4. Trough Phase: A Window of Opportunity

The trough is often when savvy investors begin buying risky assets at depressed prices. It’s a crucial time to prepare a portfolio for recovery. Remember March 2020, when markets plunged at the onset of the COVID-19 pandemic, some investors bought equities whose returns proved spectacular during the rebound.

How to Adjust Investment Strategies Based on Economic Cycles?

1. Dynamic Asset Allocation

Economic cycles often dictate optimal asset allocation. During expansion, portfolios tend to favor equities, especially in cyclical sectors. At the peak, there’s usually a shift toward defensive assets and cash. During recessions, government bonds and defensive sectors take priority. At the trough, risky assets are often reintroduced.

2. Sector Rotation

Economic sectors evolve differently across cycles. In expansion, sectors like technology, consumer discretionary, and energy are favored. In a recession, investors focus more on healthcare, utilities, and consumer staples.

3. Contrarian Approach

Contrarian investors aim to buy when pessimism is at its peak (during recessions) and sell when optimism reigns (at the peak). This strategy requires strong discipline and deep analysis of valuations.

4. Inclusion of Non-Correlated Assets

To guard against economic cycle volatility, investors can diversify with alternative assets such as gold, real estate, or cryptocurrencies.

Limits and Uncertainties of Economic Cycles

While economic cycles offer a useful framework, they are far from predictable. It’s important to remember that the length of cycles can vary. Some phases last for years, others only months. External factors such as geopolitical crises or natural disasters can abruptly alter economic trajectories. And above all, markets often behave irrationally. Investor emotions, fear and euphoria, can amplify market swings regardless of underlying fundamentals.

Economic cycles are central to the evolution of financial markets, influencing the performance of stocks, bonds, and other assets. Understanding these cycles is essential for identifying opportunities and managing risks at each stage.

However, investing based on economic cycles requires constant monitoring and the ability to quickly adapt to changes. Rigorous analysis of economic fundamentals, combined with dynamic portfolio management, can turn economic fluctuations into lasting opportunities.

For investors, it’s not just about following the cycles but about using them strategically to maximize returns and protect capital in the face of uncertainty.

Aurélien Guzzo

Executive Director