The stock market is not the economy

Many consider the performance of the financial markets to be a reflection of the good or bad health of the economy. But this is not always the case. The stock market and the economy are two concepts that do not always coincide. They can even sometimes cover opposite realities. Let’s go back to the basics to understand what distinguishes them and what brings them together.

Definition

The stock market is a place where different financial assets are traded. Companies and institutions issue securities (shares, bonds, etc.) to raise funds, while investors buy and sell these securities to acquire a right to the company’s assets and profits and to make a profit. In this way, the stock market plays an essential role in the economy, promoting growth, market accessibility, the distribution of capital and reducing conflicts of interest. Stock market movements are nevertheless conditioned by many factors, such as corporate earnings and prospects, interest rates and inflation levels, investor sentiment and confidence, and geopolitical events.

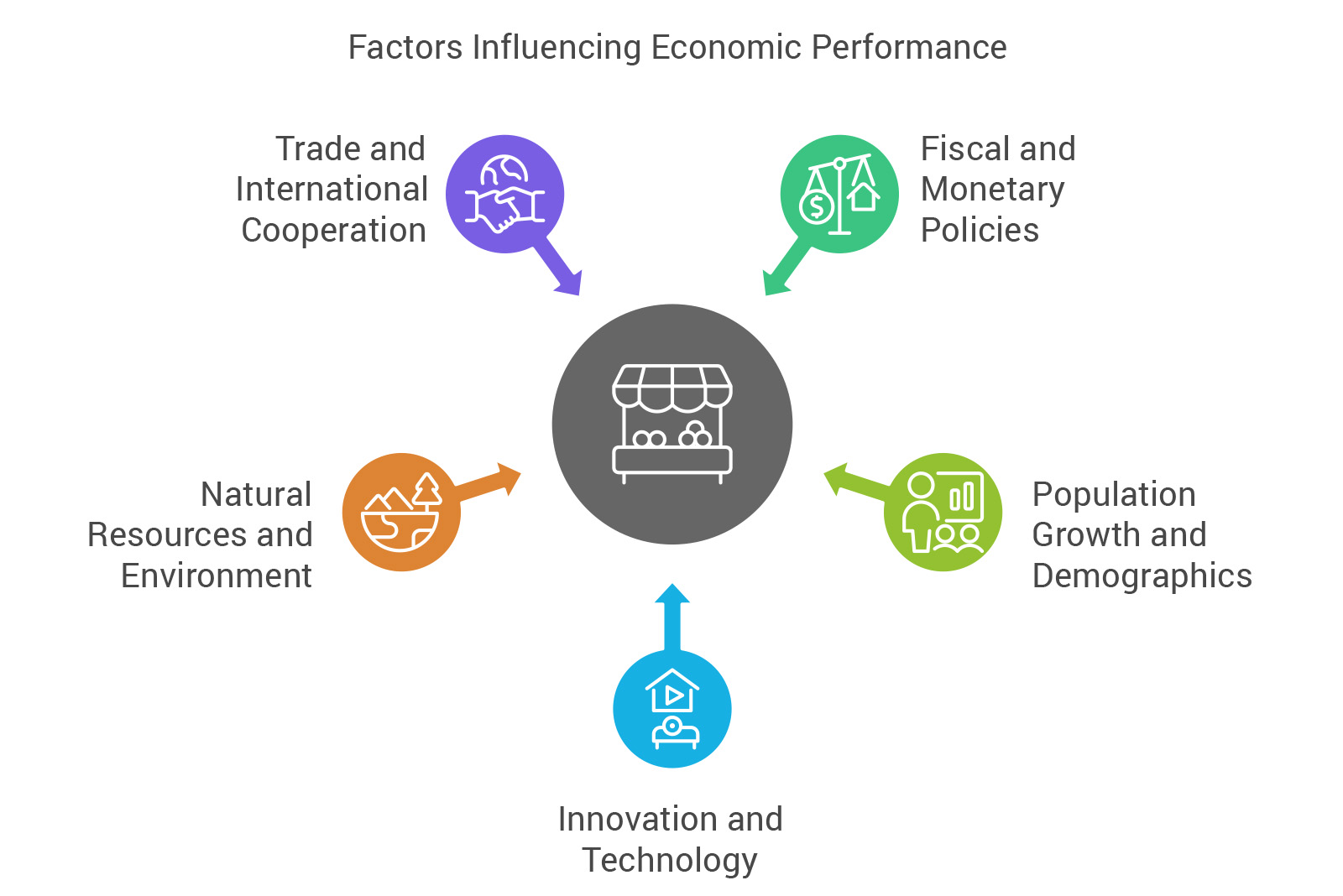

As for the economy, we usually say that it encompasses all activities linked to the production, distribution and consumption of goods and services. It is measured by various indicators, such as gross domestic product (GDP), the unemployment rate, the consumer price index (CPI) and the trade balance, to name but a few. Here too, the economy is influenced by many factors, some of which are identical to, but not limited to, the drivers of the stock market :

– The fiscal and monetary policies of governments and their central banks

– Population growth and demographics

– Innovation and technology

– Natural resources and the environment

– Trade and international cooperation

What is the link between the stock market and the economy?

In view of the definitions we have just given, the stock market and the economy are linked, but not in a simple or direct way. The stock market is prospective, i.e. it reflects investors’ expectations of the future performance of companies and the economy. The economy, on the other hand, is backward-looking, i.e. it reflects the actual results of the production and consumption of goods and services.

As a result, the stock market and the economy can move in different directions, depending on the gap between investor expectations and reality. This has been observed on several occasions in history. Here are a few examples :

The Great Depression

Triggered by the stock market crash of 1929, the Great Depression is known as the worst period of economic recession in history. After the collapse of the financial markets, the US economy contracted by almost 30% between 1929 and 1933, with unemployment at 25%. Despite a spectacular recovery in the financial markets and a rise in the Dow Jones of more than 300% after this steep fall, the economic difficulties persisted between 1933 and 1937, with the stock market taking a course diametrically opposed to that of the economy.

The dotcom bubble

The late 1990s saw a rapid rise in the share prices of technology companies. The cause was boundless optimism and excessive speculation, linked to the advent of the internet and the creation of a new economy. The Nasdaq Composite index soared by more than 500% between 1995 and 2000, reaching an all-time high in March 2000. However, the US economy was not as strong as the stock market suggested, with GDP growth slowing from 4.5% in 1999 to 3.8% in 2000. At the same time, inflation rose from 1.6% to 3.4%. All these factors ended up creating a bubble which wiped out trillions of dollars in market value and triggered a major recession.

The subprime crisis

The global financial crisis between 2007 and 2009 was triggered by the collapse of the US housing market and the credit crunch. This so-called subprime crisis plunged the US economy into a deep recession, and with it many of its partner economies. As a result, US GDP shrank by 2.5% in 2008 and 2.9% in 2009. The unemployment rate reached 10% in October 2009. While the stock market recovered quickly from the crisis, thanks in particular to stimulus measures and unprecedented intervention by governments and their central banks, the economy took years to recover from the shock. Here too, the recovery of the financial markets was spectacular, with the S&P 500 index, at its lowest point in March 2009, having recovered by more than 60% by the end of the year.

COVID-19

The shockwave caused by the drastic public health measures taken during the COVID-19 pandemic in 2020 and 2021 to limit its spread has not only disrupted the functioning of society and businesses, but also that of the global economy. As a result, the US economy suffered its worst contraction on record, with GDP down 31.4% in the second quarter of 2020 and the unemployment rate at 14.8% in April 2020. However, the stock market defied economic reality by making a remarkable comeback after the crash triggered by the pandemic. Indeed, as a result of the massive fiscal and monetary stimulus measures, but also the rapid roll-out of vaccines and the optimism that followed, the S&P 500 index set a new all-time high in May 2021.

These examples show that the stock market and the economy can sometimes diverge significantly. The stock market can rise when the economy is falling, particularly if investors are anticipating a rapid economic recovery or if companies are benefiting in some way from the recession. Conversely, markets can fall rapidly when economic growth is judged to be good. This often happens when investors fear an imminent slowdown, or if companies are facing competitive or regulatory problems.

A portfolio that holds up

While the stock market and the economy need to be considered from different angles, it is important to draw lines of convergence between the two concepts. They both influence each other in complex and dynamic ways, reflecting the collective behaviour and expectations of investors, consumers, producers and decision-makers.

That said, we should not rely exclusively on the stock market. It is not the only indicator of an economy’s health. The reverse is also true. In other words, basic economic data such as GDP and money supply alone cannot form the basis on which investors think. That’s why it’s important to avoid overreacting when short-term fluctuations rock the markets or the economy. This is also why portfolio diversification, by balancing sectors, industries, geographical zones and asset classes, remains the most effective tool for minimising exposure to risk and protecting against the uncertainties generated by the markets and the economy.

Joan Bürgy

Investment Specialist

You may also like

Market Update – July 2025

June was anything but quiet, yet markets chose to look through the noise. Global equities added another 4-5% for the month, pushing the MSCI ACWI to a double-digit gain year-to-date.

Télomère participates in Bloomberg Women in Finance

Télomère was pleased to take part in the Bloomberg Women in Finance event, an essential moment dedicated to advancing women’s presence and impact in the financial sector.

What impact do economic cycles have on financial markets?

Economic cycles, true oscillations of economic activity, lie at the heart of financial market dynamics.